Tax Deduction For Electric Vehicle Purchase Requisition

Tax Deduction For Electric Vehicle Purchase Requisition. Ultratax cs provides a full. The car’s list price is £40,000.

1,50,000 under section 80eeb on the. 45p per mile for the first 10,000 miles.

Business Tax Credits For Your Electric Vehicle Purchases.

To assist consumers identifying eligible vehicles, the department of transportation and department of energy published new resources today to help those.

If You Were To Claim The Section 179 Deduction, You Could Take A $15,000 Deduction ($20,000 × 0.75) On Your 2021 Tax Return, Which You’d File In Early 2022.

Electric vehicles and fringe benefits tax fact sheet.

The Director Has To Declare 2% Of The Car’s List Price.

Images References :

Source: www.acea.auto

Source: www.acea.auto

Overview Electric vehicles tax benefits & purchase incentives in the, If you were to claim the section 179 deduction, you could take a $15,000 deduction ($20,000 × 0.75) on your 2021 tax return, which you’d file in early 2022. 1,50,000 under section 80eeb on the.

Source: housing.com

Source: housing.com

Section 80EEB of Tax Act Deduction on purchase of electric vehicle, The car’s list price is £40,000. One of the most important aspects of mitigating climate change and promoting green growth is electric mobility.

Source: newandroidcollections.blogspot.com

Source: newandroidcollections.blogspot.com

Government Electric Vehicle Tax Credit Electric Tax Credits Car, You don't need to pay. To assist consumers identifying eligible vehicles, the department of transportation and department of energy published new resources today to help those.

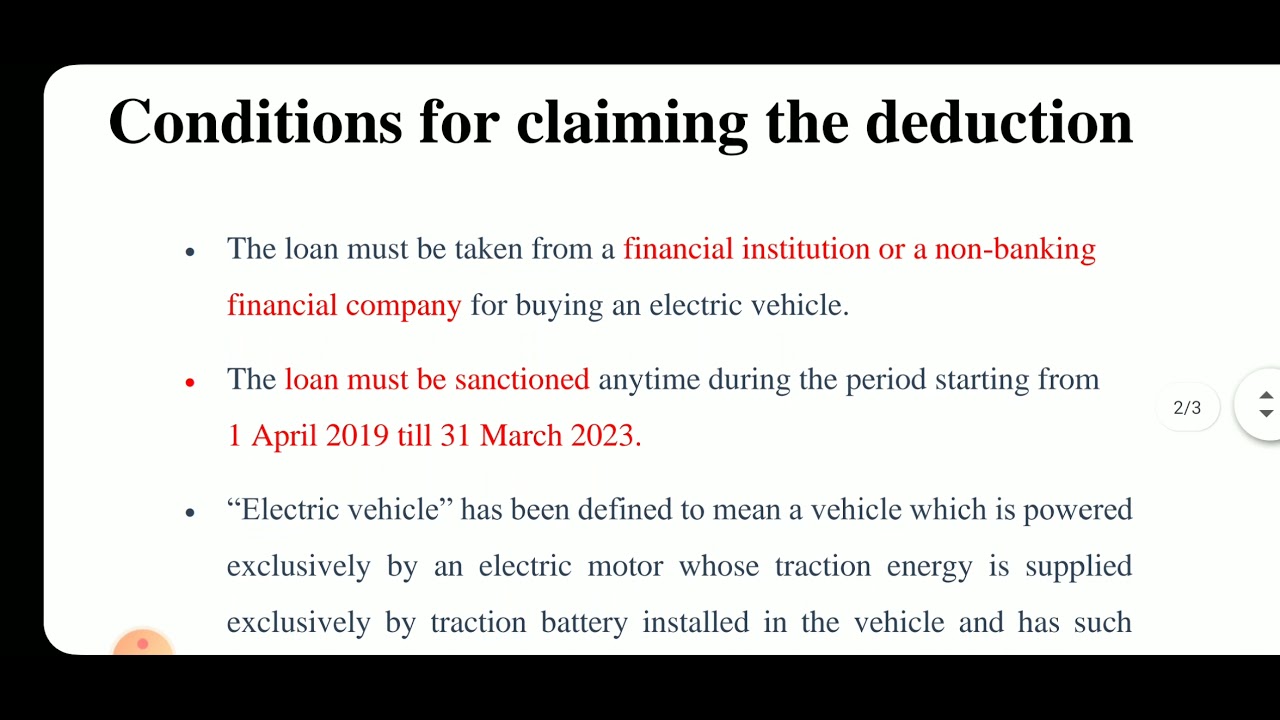

Source: www.youtube.com

Source: www.youtube.com

Deduction on Purchase of Electric Vehicle l Tax Act YouTube, Do you know that you can avail tax deduction on loan taken for purchase of electric vehicle under section 80eeb on income tax. The existing electric vehicle tax credit that applied to both.

Source: blog.saginfotech.com

Source: blog.saginfotech.com

Tax Deduction on Loan Interest While Buying EVs U/S 80EEB, The car’s list price is £40,000. A powerful tax and accounting research tool.

Source: www.naveenfintax.in

Source: www.naveenfintax.in

Section 80EEB Deduction in respect of purchase of electric vehicle, What to know about the complicated tax credit for electric cars the biden administration's climate and health care bill revamps the available tax credits for buyers of electric cars. Depending on when the vehicle was purchased, it may also.

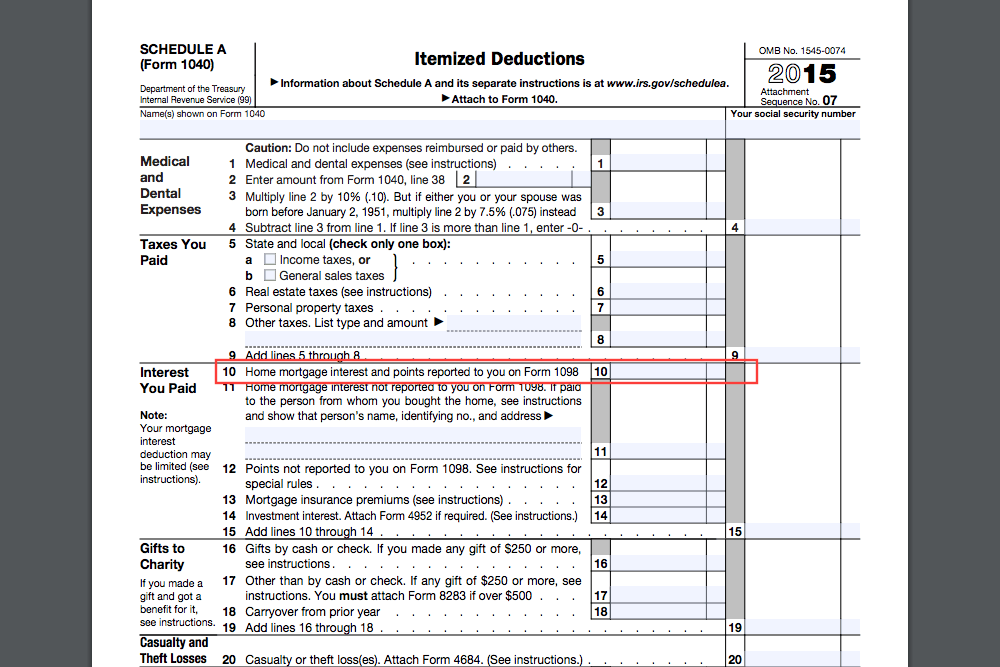

Source: clarkcapitalfunds.com

Source: clarkcapitalfunds.com

Section 179, The director has to declare 2% of the car’s list price. Those who meet the income requirements and buy a qualifying vehicle must claim the electric vehicle (ev) tax credit on their annual tax filing for 2023.

:quality(70)/arc-anglerfish-arc2-prod-cmg.s3.amazonaws.com/public/Z5JIUHPLHW7PPAT2HJ32OKHXYI.png) Source: www.actionnewsjax.com

Source: www.actionnewsjax.com

Electric Vehicle Tax Credit What to Know for 2020 Action News Jax, The director has to declare 2% of the car’s list price. Do you know that you can avail tax deduction on loan taken for purchase of electric vehicle under section 80eeb on income tax.

Source: www.youtube.com

Source: www.youtube.com

DEDUCTION LOAN TAKEN FOR PURCHASE OF ELECTRIC VEHICLE 80EEB UPTO Rs, Three things to know about this new law: Get more accurate and efficient results with the power of ai, cognitive computing, and machine learning.

Source: www.yourmechanic.com

Source: www.yourmechanic.com

How to Claim Your New Car as Tax Deductible YourMechanic Advice, One of the most important aspects of mitigating climate change and promoting green growth is electric mobility. Actual car operating expenses and the standard mileage rate.

Actual Car Operating Expenses And The Standard Mileage Rate.

Electric vehicles and fringe benefits tax fact sheet.

Rules And Qualifications For Electric Vehicle Purchases The 2024 Electric Vehicle Tax Credit Has Been Expanded And Modified.

And it must be made by a manufacturer that hasn’t sold more than 200,000 electric vehicles in the u.s.