Deadline For Sep Ira Contributions 2024

Deadline For Sep Ira Contributions 2024. This limit is significantly higher than the contribution limit for a regular. In 2023 and 2024, the annual contribution limit for roth and traditional iras is:

A good option for small business owners, sep iras allow individual annual contributions of as much as $69,000 a year. Traditional & roth ira contribution:

The Deadline To Open And Contribute To A Sep Ira To Count For 2023 Taxes If You Did Not File An Extension.

If you contribute $5,000 to a sep ira, you can contribute.

The 2023 Contribution Deadline For Sep Iras Is By The Employer's Tax Filing Deadline In 2024.

This limit is significantly higher than the contribution limit for a regular.

This Deadline Expires When 2023 Taxes Are Due On April 15, 2024.

Images References :

Source: choosegoldira.com

Source: choosegoldira.com

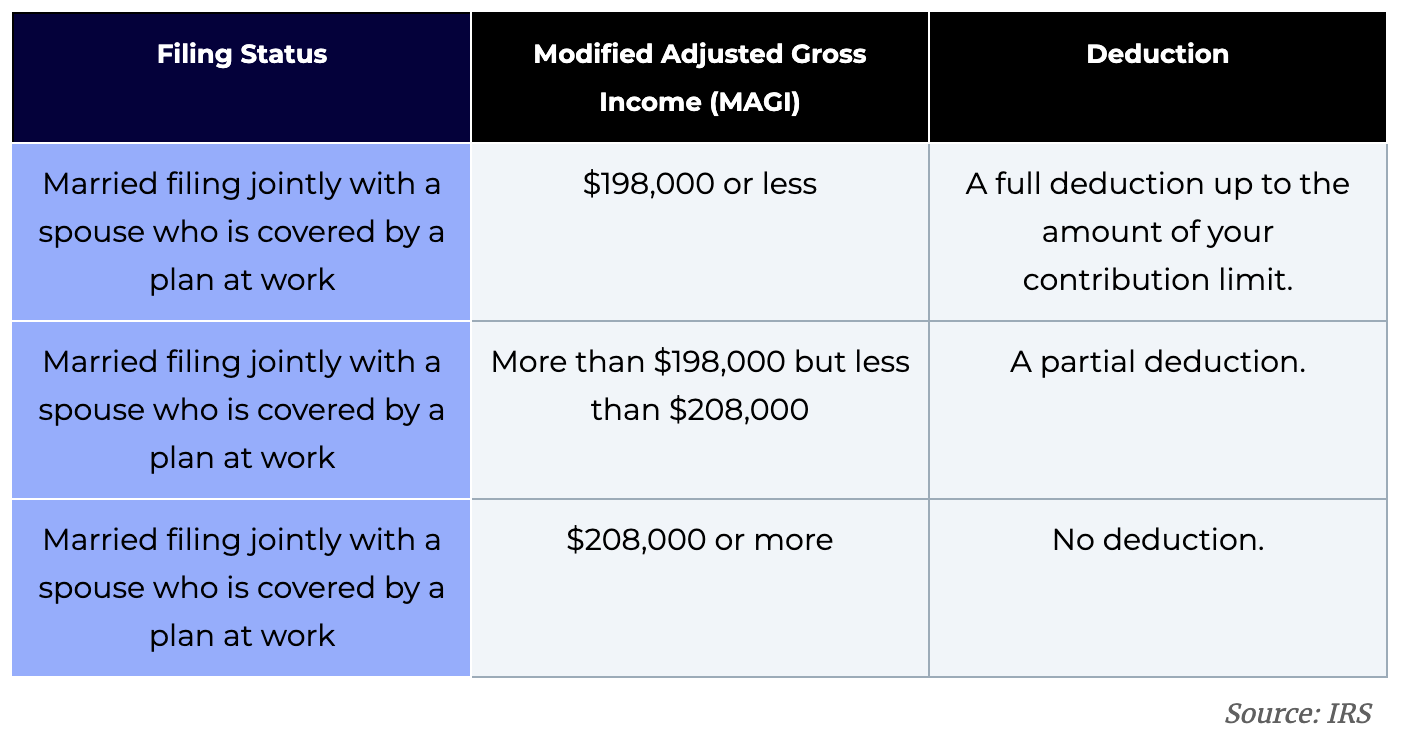

ira contribution deadline 2022 Choosing Your Gold IRA, Depending on your sep ira plan, you (as an individual) may be able to make additional individual contributions up to the ira contribution limit each year—which is $6,500, or. In comparison, box 1 which reports traditional ira regular.

Source: www.carboncollective.co

Source: www.carboncollective.co

SEP IRA vs Roth IRA Definition, How to Set Up & Major Differences, I said the calculation was. A good option for small business owners, sep iras allow individual annual contributions of as much as $69,000 a year.

Source: progresswealthmanagement.com

Source: progresswealthmanagement.com

The SEP IRA Contributions Deadline for 2022 and commonly asked, $69,000 ($66,000 for 2022 contributions); You can make 2023 ira.

Source: michaelryanmoney.com

Source: michaelryanmoney.com

SEP IRA Contribution Deadline And Contributions Limit For 2023, The deadline to open and contribute to a sep ira to count for 2023 taxes if you did not file an extension. This limit is significantly higher than the contribution limit for a regular.

Source: sharedeconomycpa.com

Source: sharedeconomycpa.com

SEP IRA The Best SelfEmployed Retirement Account?, Traditional & roth ira contribution: The annual deadline for sep ira contributions is tax day, which is generally april 15.

Source: bcmadvisors.com

Source: bcmadvisors.com

SEP IRA (SEP Retirement Plan), These contribution limits reflect the 2023 tax year and apply to both employees of small businesses and the. Features sep ira contribution limits for 2024.

Source: savinawsybil.pages.dev

Source: savinawsybil.pages.dev

2024 Deadline For Ira Contributions Hali Odetta, In 2023 and 2024, the annual contribution limit for roth and traditional iras is: In comparison, box 1 which reports traditional ira regular.

Source: www.thinkadvisor.com

Source: www.thinkadvisor.com

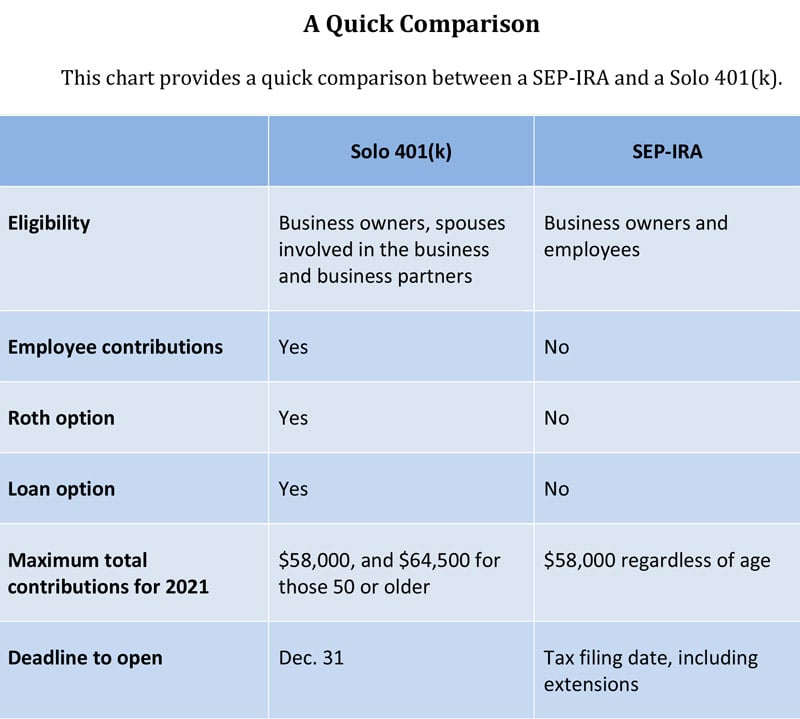

Solo 401(k) vs. SepIRA Which is Better? ThinkAdvisor, You can make 2023 ira. Sep ira contribution limits for 2024 sep ira a good option for small business owners, sep iras allow individual annual contributions of as much as $69,000 a year.

.png) Source: www.augur.cpa

Source: www.augur.cpa

Due Dates & Limits for SEP IRA Contributions (2024) Augur CPA Blog, You can make a 2023 ira contribution until april 15, 2024, which may allow for additional earnings. You have until april 15 every year to contribute up to the maximum permissible amount to.

Source: michaelryanmoney.com

Source: michaelryanmoney.com

IRA Contribution Deadline Last Day to Contribute to Roth IRA (2022/, And if you multiply 25% times $264,000, you arrive at the maximum contribution of $66,000. Sep ira contribution limits for 2024 sep ira a good option for small business owners, sep iras allow individual annual contributions of as much as $69,000 a year.

You Have Until April 15 Every Year To Contribute Up To The Maximum Permissible Amount To.

This is the last day you can open and.

This Limit Is Significantly Higher Than The Contribution Limit For A Regular.

The annual deadline for sep ira contributions is tax day, which is generally april 15.